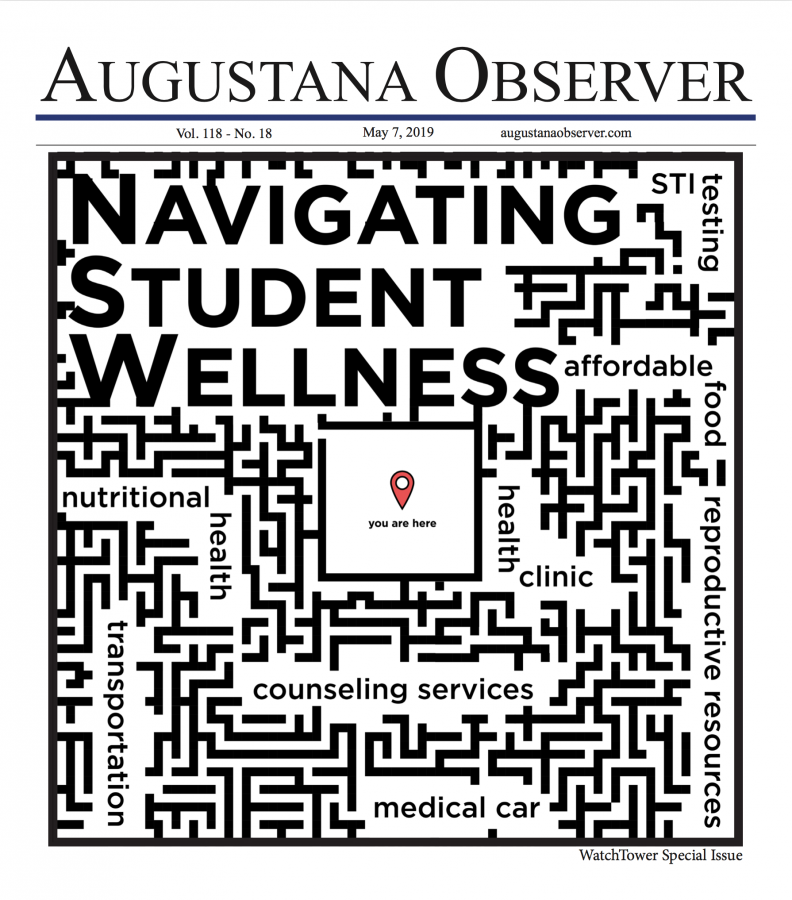

Doctor appointments, dentist visits and sports physicals all have something in common: they either require health insurance or out of pocket costs on the individual.

“When I was in school, I was never seen for my illnesses,” Haley Ochs, Augie alum 2019, said. “I knew that I often could not afford to pay for the co-pay because I purchased crappy insurance, and I figured most of my illnesses were viral in nature, so I just waited them out.”

For most of Ochs’ time at Augustana she had state insurance, but a slight increase in her income caused her status for state insurance to be denied. Ochs bought insurance with a third-party provider during her last year at Augustana.

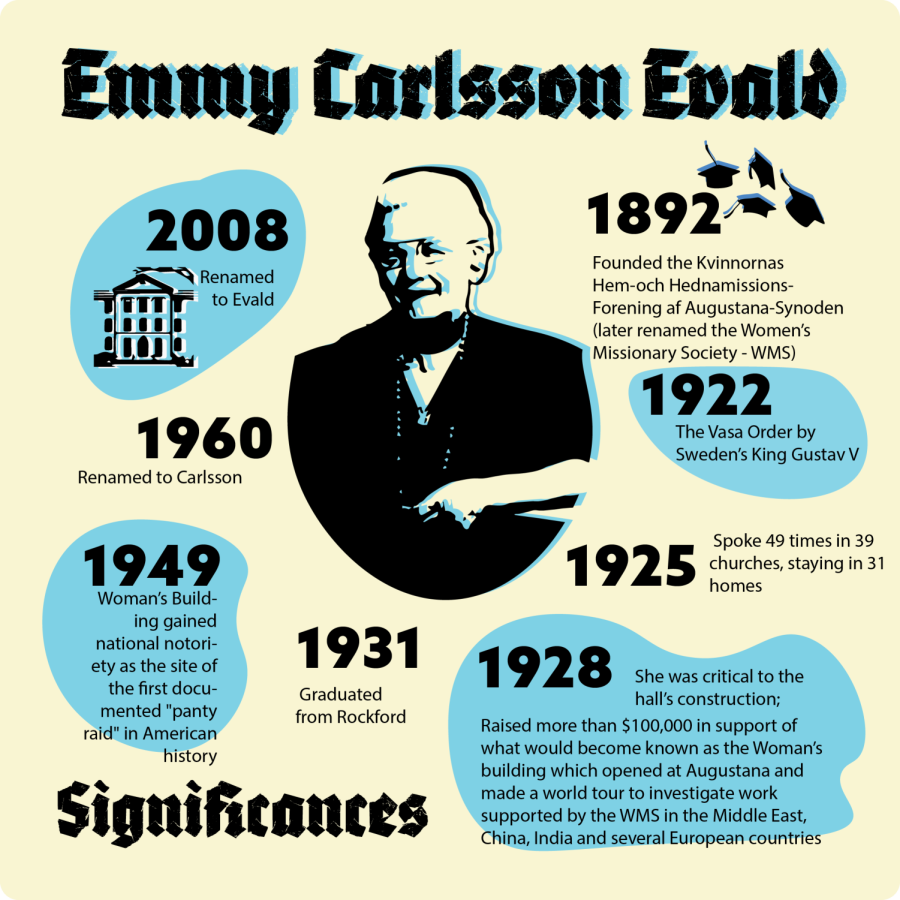

Tammy Sullivan, executive assistant in the business office, works with the insurance broker Gallagher & Company. Gallagher takes Augustana’s 2,500 students and finds insurance companies that have the best rates for the college.

“National Guardian Life is the insurance company that we have this year,” Sullivan said. She estimates around 200 students are currently signed on with the insurance company.

“The rest of them are covered by their parent’s insurance through an employer. We do have several students on Illinois Medicaid, so they’re covered by the state.

“We also have Iowan students on Medicaid and that doesn’t transfer to Illinois, but it’s close to home so they can go across the river and get service there. They would waive the insurance [through Gallagher].”

Sullivan says the college will tell the insurance provider that all 2,500 students could participate in the school’s insurance plan.

This way the insurance provider offers a better rate for students, yet that means for students who do have insurance already or may not afford certain plans will have to waive Gallagher.

If not, the billing office will add the insurance plan cost to their account. According to Sullivan, insurance companies require a hard waive when they conduct business with groups like the college.

After the Sept. 6 deadline the charge becomes final and the college technically pays for the student. However, the student must pay the college back.

Sullivan says that the business office will help split the payment plan, but once the deadline passes and a student doesn’t waive, they are responsible for paying for the insurance plan.

“Admittedly it can be a hassle for someone who doesn’t need it,” Sullivan said. “We only have 200 people who use it and the majority are not. The ones that need it, need it at a rate they can afford.”

Nadia Ayensah, senior, says both of her parents are pharmacists in Ghana where there isn’t really a hassle to get the necessary medication. But when Ayensah started to attend Augustana, her experience with healthcare changed dramatically.

“I went with a health insurance plan suggested by a friend because it was cheap,” Ayensha said. “Augustana’s health plan was too expensive. All the other ones I’d looked at were really expensive. I did not see this to be a worthy investment because I knew for sure I was not going to be using the health systems in place here.”

Ayensah avoids going to the clinic unless absolutely necessary. Since she’s been at Augustana she has only gone to the clinic once and all she needed was an antibiotic.

“I was baffled by the price I was quoted at the end,” Ayensah said. “I ended up paying $250 and I didn’t think it would be $250 to write a prescription.”

Some Augustana students play a game of, “Should I attend class if I feel sick?” Senior Caitlin Wheeler has an additional issue on top of this dilemma.

“Commuters are hit rough with this,” Wheeler said. “I have to either drive an hour to school to attend class already feeling unwell, or risk getting marked as an unexcused absence.

“Professors don’t ask me for doctors notes, but they do only allow two sick/excused absences before they start deducting your grade, which is not only hard on your health but also on our education.”

The requirement of doctor notes from some professors also inadvertently forces students to go to a clinic and pay to be given a piece of paper.

“I did have a few classes that expected doctor’s notes, but I accepted the penalty or went to class while sick,” Ochs said.

“Personally, I think that this policy is ridiculous. I understand that they’re attempting to persuade students against skipping class, but at the same time, medical care in the United States is too expensive.

“We’re putting students in debt, just to be told that they have a viral illness and need to rest. Otherwise they have to go to class, likely perpetuating their illness because they do not have time to rest. Or they accept the consequence associated with missing class, which decreases their grade for something that is completely out of their control.”

Sullivan mentions that a small number of students on campus don’t have insurance, with “I couldn’t even give you a number because it is so low.”

Augustana does not require students to have insurance to attend college, but it is highly encouraged.

“The only time it affects whether or not they can be here if they didn’t waive and that charge is on their bill,” Sullivan said. If you have a charge over $500 on your bill then you can’t register for courses.

“So it is really important for the students who don’t want insurance they make sure to go online and waive the insurance, through the online process though Gallagher.”

Sullivan says that the college wants to offer insurance to students, because in college once someone is sick usually the closest people around them fall ill too.

Again, it is not required, but the college deals with Gallagher and Co. and it’s hard waive to offer the best rate possible in order to keep students in class and not home sick.

Sullivan says National Guardian Life has lower deductibles, which is the amount you pay out of pocket before service, compared to $1000 deductibles found through employer plans.

Even though the current plan has deductibles of $150 in-network, meaning a hospital has an agreement with the insurance company, or $300 out of network, it can still be too expensive for many college students.

“I feel like this is something I can speak on behalf of all international students. Everyone knows that it is very expensive to go to the clinic here, to seek medical help here,” Ayensah said. “Everyone tries as best as possible to avoid going to the clinic. For most international students if you see someone go into the clinic it is for something serious. Everyone tries to wait it out. You know how here if someone got the flu they would rush to the clinic to get shots and what not, but it is not the same way for international students, we wait it out.”

Ayensah says that many international students are advised to bring medication from home along with a first aid kit in order to avoid the costs of the American healthcare system.

The Augustana community is discussing if a health clinic should be on campus.

“While I think getting a clinic would be nice, as it makes medical care more accessible, I do not think that it gets to the root of the issue,” Ochs said. “In order for students to have full access to medical care, the cost of insurance, big pharma, and medical care needs to decrease.”

Even for Ochs’ friends, the dealings with the healthcare and insurance systems have made tragic health emergencies far worse.

“I had friends who had been raped and others experiencing suicidal ideations, but they expressed concern at going to the Emergency Department to be seen, because they knew their parents would be upset with receiving the medical bill,” Ochs said.

Additional reporting by Audrianna Schneider.

Alex • Mar 6, 2020 at 5:43 pm

I find your article a bit hard to take. It is hard to believe that students who attend a college with a price tag of roughly $56,352 per year walk around complaining about a doctor bill that is $250 a visit. It is my experience that people do not like to pay for things they cannot use to impress people they don’t know and don’t like. How much money do these students waste per year buying alcohol, Starbucks coffee, eating out, etc. That Starbucks coffee is a status symbol that a cup made in your dorm or apartment doesn’t carry with it as you walk around campus. No one holds up their prescription as a status symbol of wealth. Those same kids who refuse to stay home and get other sick are another issue that should be addressed. Once you enter the real world you will find that regardless of policy you always get a doctors note to present to your boss (or profession in this case). If it comes down to an issue where your grade is going to be impacted you have the doctors note in which to fight the decrease in grade due to absenteeism. In essence, CYA (cover your ass) is the most important lesson you can learn about life. For those who need prescription drug coverage, I suggest you download the GoodRx app. Tell your doctor to write you a script and take it to the pharmacy that has the best price for the drug you are given. In many cases, the doctor will help you with samples if you do not have insurance.