Student Loan Forgiveness: Is there really room for compromise?

February 26, 2022

Student loan debt and the ability to pay it is a major factor in the future economic success of college students, both at Augustana and throughout the United States.

Forgiving a part of college student loan was one of the major aspects of Biden’s presidential campaign, with his pledge to support legislation that would forgive up to $10,000 in student loan debts per borrower, being critical in voter decision making. However, at the dawn of his second year of presidency, this pledge has been pushed to the side in the name of compromise, allowing for alternative issues to be addressed at the expense of America’s college students.

Student loan forgiveness and the economic safety net it provides gives many students increased opportunities to pursue higher education and are vital in their ability to succeed economically after college graduation. With nearly 4.5 million people owing the U.S government between $100,000 and $200,000, according to the US Chamber of Commerce, it is economically essential that students have the opportunity to have a part of their debt forgiven.

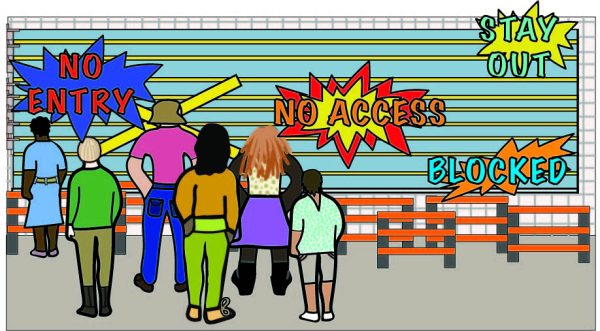

Some may argue that students can get their federal student loans forgiven if they are unable to pay, specifically through declaring bankruptcy or sharing clear evidence of hardship that prevents them from paying the loan off. However, these ‘protections’ against debt have been steadily growing smaller in the margin of those who fall under their requirements – further limiting those who can escape their student loan debt.

But this raises the question: Why is it that students can only have debt forgiven when their economic standing has already been compromised? Is it ethical for politicians to refuse to waive debt until students and graduates are in the direst of financial circumstances?

Given the current system regarding student loans and the overarching acclimation of debt within the United States, the forgiveness of student loans through the Biden administration allows America’s college students to start out on the right path for success.

Not only that, but the administration is capable of enacting legislation to support student loan forgiveness.

In an interview with the New Yorker, politician and activist Alexandria Ocasio-Cortez said, “[o]ne of the single most impactful things President Biden can do is pursue student-loan cancellation. It’s entirely within his power.[…] It’s very much a keystone action politically [and] economically.”

In terms of Biden’s power to act on his support of student loan forgiveness, the president himself has expressed doubt in his ability to do so, resulting in a lag in loan cancellations, and the role this legislation played in rallying supporters.

Yet, many would argue that it is within his executive power to champion this legislation, which is only exemplified through his economic efforts surrounding alternative policies relating to the Build Back Better agenda. He had success in forgiving “the debt of roughly 675,000 borrowers,” according to the Wall Street Journal.

So, yes, the administration is capable of forgiving student loan debt, and I would argue that it should do so for the greater good of American college students.