With graduation around the corner, seniors will have a major financial burden to carry, in the form of student loans. Illinois’ 17th Congressional District Cheri Bustos recently spoke on the matter at BlackHawk College on April 17.

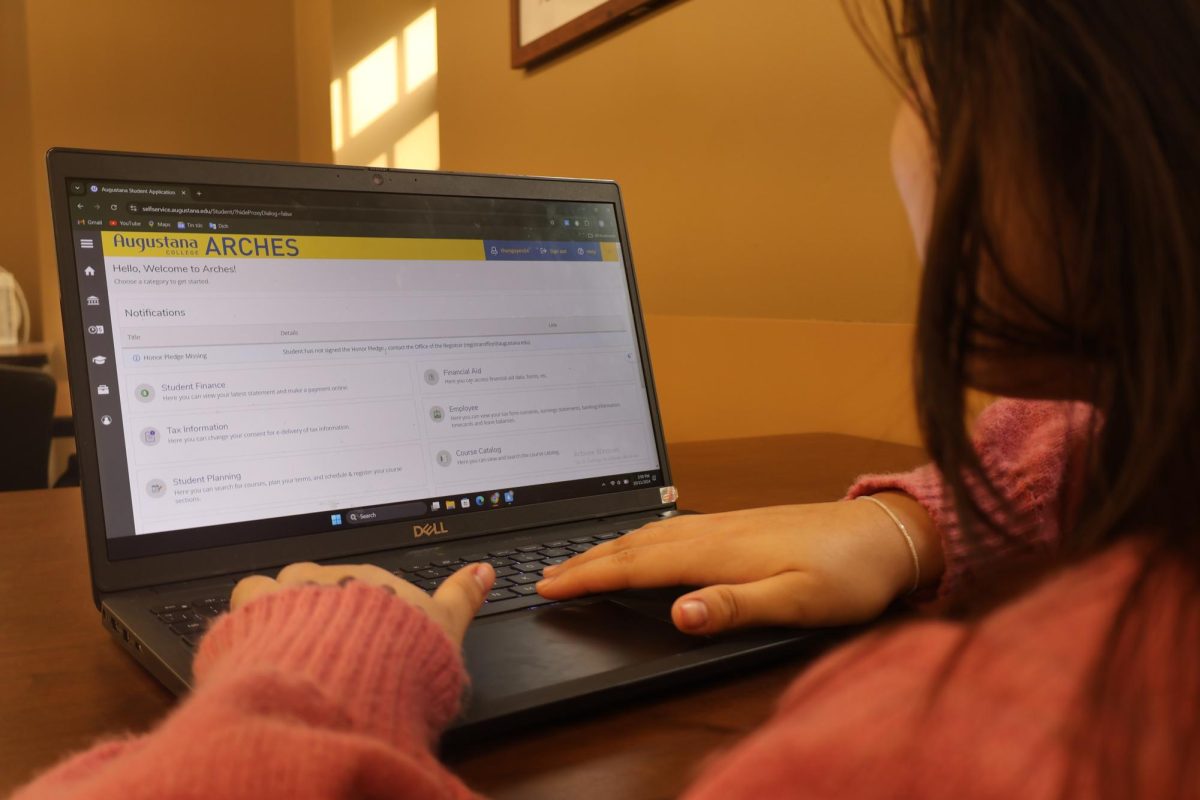

Bustos co-sponsored the Student Loan Interest Deduction Act of 2015 in January along with 56 other congressmen. The legislation would increase the maximum tax deduction for interest paid on any qualified education loan to $5,000 and repeal the limitation on such deduction based upon modified adjusted gross income.

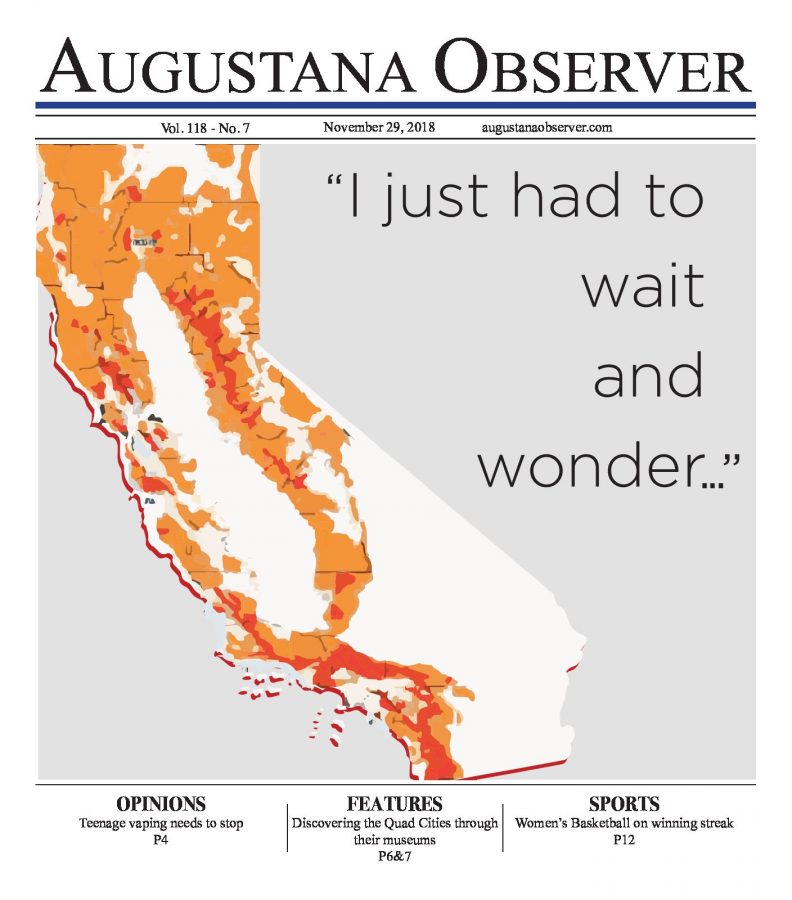

According to David Myatt, associate director of financial assistance, 77 percent of four-year graduates from the class of 2014 had borrowed Federal Direct Direct Stafford/Federal Perkins and/or a private student loan, totaling an average of $31,612 per student.

While there has been a trend of small increases in percentage each year, four-year graduates from the class of 2013, where 72 percent of graduates borrowed Federal Direct Direct Stafford/Federal Perkins and/or a private student loan, had a larger average debt, averaging $32,201 per student. This shows a trend of increasingly more students borrowing federal or private loans, but averaging less debt. In 2013, Illinois graduates had an average debt is $28,543,according to the non-profit American Student Assistance.

However, the debt continues to grow, and may become a problem for future generations.

” In terms of size, the amount of student debt outstanding has recently surpassed both car loans and credit card debt,” said Joanna Short, professor of economics. “During the recession, people reduced their consumer debts with the exception of student loans.”

Augustana’s student loan debt is consistent with current national patterns. In 2012, 71 percent of all students graduating from four-year colleges had student loan debt, according to the Institute for College Access & Success. At private nonprofit colleges, the average debt was $32,300. About one-fifth of overall national student debt is in private loans.

The total amount of student debt in the U.S. is approximately 1.2 trillion dollars and about 47 percent of students graduate with over $20,000 in debt in 2012, according to the Urban Institute.

Growing students loans correlate directly with rising tuition costs, yet students still find the expense worth the risk.

“I do think that what I will get from Augustana will be just that beneficial,” said junior Nick Caputo. “That’s just part of life at this age. You’ve got to pay your debts, because you will have a few.”

While academics, athletics, and other factors are on students’ minds, the financial burden is a factor for anxiety.

“As I think they already are, students should factor in debt burden as they choose a college or graduate school,” said Short. “The more important this is to students, the more schools will have to slow tuition increases.”

Categories:

Student loan debt totals $31,000

May 4, 2015

0

More to Discover